Why Rivers considers lending to all business sectors

One of the things that sets Rivers apart as an alternative lender is our willingness to consider funding for any business, regardless of the sector they operate in. Where lots of our competitors specialise in one area or actively avoid certain sectors because there's a perceived risk associated with it, we look at the strength of the business itself and consider funding based on its individual merits.

Business sectors many lenders won't finance

At Rivers we are quite unusual because we are a non-sector-specific lender. While lots of lenders limit the industries and assets they're prepared to finance, and others proactively exclude certain sectors considered high risk, such as hospitality, construction, air conditioning, businesses focused on cigarettes or vapes, and gambling-based organisations, we don’t.

As an independently run SME, Rivers was established to meet the needs of other business owners and their enterprises, understanding that the hard facts of a business are just one part of the story. As a result, we chose to be non-sector-specific, and in broad terms will consider any business for a business loan, as long as they meet our minimum lending criteria.

That approach offers benefits to us as a business and to our clients as well, ultimately giving us greater strength on which to be a reliable lender and business partner for SMEs seeking finance.

Rivers minimum lending criteria

At Rivers we start by asking for key criteria and information so we can give you a quick answer as to whether a loan offer is likely. Then we get into more detail to confirm the specifics of what that might look like. To get you started, here's a reminder of our minimum eligibility criteria:

- The business needs to be registered in England or Wales It must be a Limited Company or LLP

- At least one of the business owners must be a homeowner

- Minimum trading times for short-term corporate loans are from three months trading onwards

- For medium-term loans minimum trading times are from six months trading times onwards

- No active County Court Judgements (CCJs)

Other benefits of being non-sector specific

As we don't place specific emphasis on the sector that a business operates in, not only will we consider business in all sectors for funding, but we also don't price differently because of the perceived risk in any given industry either. Once again, your business just needs to meet our underwriting criteria.

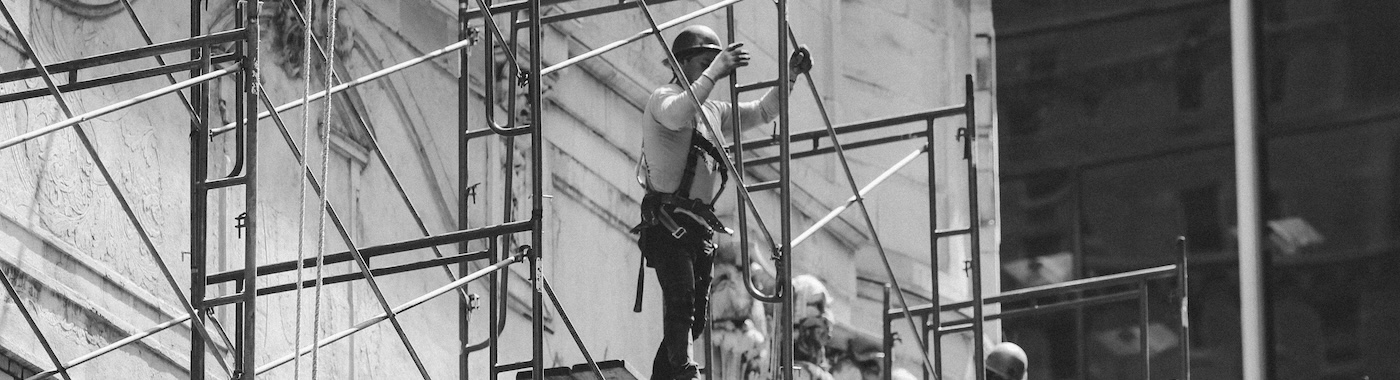

For example, two separate businesses recently approached us - both were scaffolding companies. They assumed we wouldn't be able to help because they had tried other lenders before, but in both cases, we were able to provide funding.

Rivers' Business Development Manager – Corporate Loans, Ian Mills, says: "I have never worked for a lender that works with scaffolding companies before because it's deemed risky for a variety of reasons, but Rivers works differently. It's one of my great pleasures after more than 30 years in business finance, to work for a company where I have been able to provide support for businesses that other institutions simply cannot offer SMEs."

Why we’re not preoccupied with sector or asset-type

Ultimately, we're interested in the big picture when it comes to businesses, not one isolated aspect like the sector they operate in. Our business is to lend money, but our purpose is to help businesses to thrive because that way everybody wins.

We're excited to see businesses grow and be successful. It's the mentality that Rivers was built on. That's why your sector isn't the thing we're most focused on - it's where you're planning to take your business that excites us.